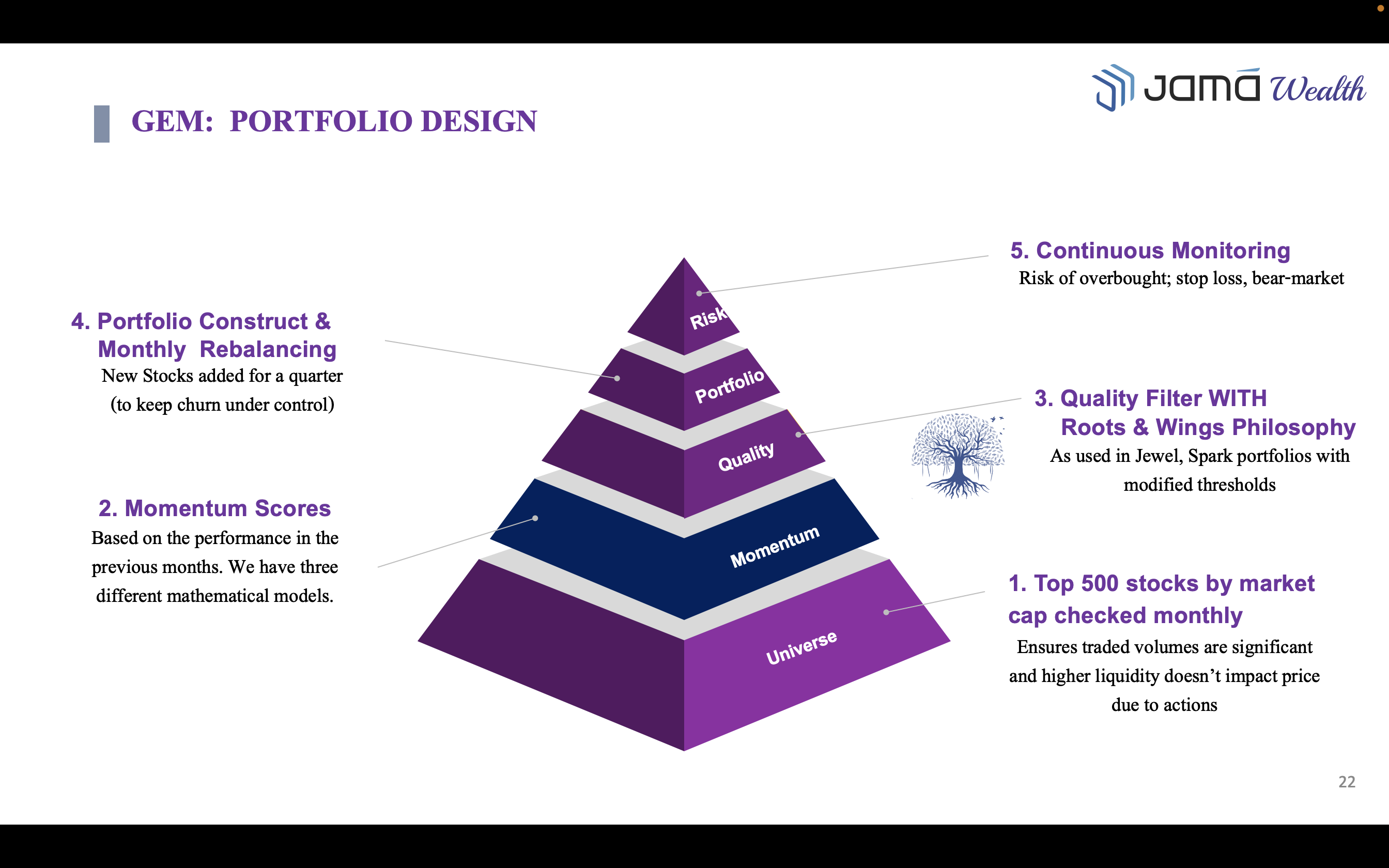

GEM: Growth in quality Equities with Momentum

Maximising Returns through Quality Plus Momentum

Our unique GEM PMS strategy harnesses market trends in quality stocks for optimal portfolio performance. We pick good quality stocks that are trend and manage risk actively to generate superior returns.