June 4, 2024 has seen a significant market reaction following an apparent hung parliament verdict. It is not a hung parliament actually because the prepoll Nation Democratic Alliance (NDA) has a comfortable simple majority. The market was disappointed that BJP on its own did not get a simple majority. Is the fall of 5.93% in Nifty 50 really bad? Let us compare this with what happened during previous such events and understand if this is a ‘bad event’ or an opportunity in disguise.

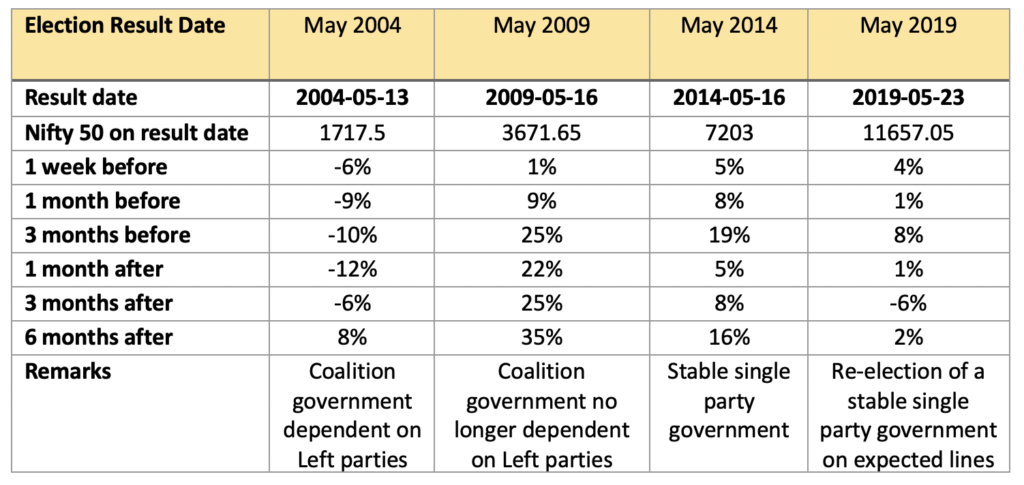

We have seen significant market reactions following general election results in the past too. Here’s how the markets reacted immediately after recent four election results. I will cover the previous eight election results in the subsequent paras.

As we can see, the markets do not like surprises, especially those involving uncertainty and instability (like in 2004). Positive surprises like in 2009 and 2014 which heralded a more stable governments boosted markets. We will now study what happened in the run up to the elections and then what followed after the event followed by the market’s growth trajectory 6 to 12 months post-election and the factors influencing this growth.

1. 2019 (May 23)

– Immediate Reaction : The markets reacted positively to the BJP’s decisive win, reinforcing expectations of continued reforms and strong economic governance. The expectations was that of continued political stability.

– Growth in the next year : The market experienced moderate growth, around 10-15%, over the following year.

– Reasons : Continued economic reforms, efforts to improve ease of doing business, and infrastructure development contributed to market growth, despite global economic uncertainties.

2. 2014 (May 16)

– Immediate Reaction : The markets reacted extremely positively, hitting record highs, due to the BJP’s landslide victory led by Narendra Modi. This was a real surprise.

– Growth in the next year : The market saw robust growth, with the Nifty 50 index rising by about 40% over the year.

– Reasons : Expectations of significant economic reforms, including the introduction of GST, labor reforms, and initiatives like “Make in India,” boosted investor sentiment.

3. 2009 (May 16)

– Immediate Reaction : The markets surged, recording one of their biggest single-day gains, due to the clear victory of the Congress-led UPA coalition.

– Growth in the next year : The market maintained strong growth, increasing by approximately 35% over the next year.

– Reasons : Political stability and continued economic reforms, along with global economic recovery post the 2008 financial crisis, contributed to market growth.

4. 2004 (May 13)

– Immediate Reaction : The markets experienced a sharp decline due to unexpected election results and fears of economic reform rollback under the Congress-led UPA coalition government. The complete dependence on the Left parties spooked the markets.

– Growth in the next year : Despite the initial dip, the market rebounded and grew by nearly 20% over the next year. This is important to note in the context of the 2024 election results.

– Reasons : The UPA government continued with reform policies and focused on infrastructure development, which helped restore investor confidence.

5. 1999 (October 6)

– Immediate Reaction : The markets reacted positively to the BJP’s decisive victory.

– Growth in the next year : The market grew by about 25% in the following year.

– Reasons : Political stability and continued economic reforms, including disinvestment in public sector enterprises, were key drivers of growth.

6. 1998 (March 6)

– Immediate Reaction : The markets initially dipped due to concerns over political stability as the BJP formed the government with a slim majority.

– Growth in the next year : The market recovered and grew by approximately 15% over the next year.

– Reasons : The BJP-led government continued with economic reforms and policies that favored continued market liberalisation, boosting investor sentiment.

7. 1996 (May 27)

– Immediate Reaction : The market was volatile due to political uncertainty as no single party gained a clear majority.

– Growth in the next year : Despite initial volatility, the market saw moderate growth of around 10% over the following year.

– Reasons : The establishment of a stable government under Prime Minister H.D. Deve Gowda provided some stability, and economic reforms continued, though at a slower pace.

8. 1991 (June 16)

– Immediate Reaction : The markets reacted positively following the 1991 elections due to the expectations of economic liberalization under P.V. Narasimha Rao’s leadership.

– Growth in the next year : The BSE Sensex surged by approximately 30% over the next year.

– Reasons : Major economic reforms were introduced, including liberalization, privatization, and globalization policies. These reforms significantly boosted investor confidence and attracted foreign investments. 1991 is even now seen as a landmark year when the then Prime Minister PV Narasimha Rao launched these sweeping economic reforms.

Conclusion

The Indian equity markets have generally responded positively to clear election outcomes that promise political stability and economic reforms. Key drivers for market growth include the following (these are not specific to election results alone):

- Economic Reforms : Policies aimed at liberalization, privatization, and globalization. We can expect more of these given that NDA comprises of forward looking parties like TDP.

- Political Stability : Stable governments with clear mandates instill investor confidence. NDA has a comfortable majority assuming that the pre poll partners continue.

- Government Initiatives : Specific programs like infrastructure development, ease of doing business, and investment in technology and innovation. There are massive plans for doing this.

- Consumption : India has a huge domestic consumption that is growing rapidly.

These factors collectively contribute to the growth trajectory of the Indian markets in the months following general election results. There is no sign that this will not happen during 2024 and 2025. Further, India has no dearth of elections and a coupe of major wins by the ruling party in Maharashtra or UP could set the investor sentiment in the direction of ‘stability’.

For those seeing some despair at the sudden market rout today, the above episodes clearly carry a lesson that long term investors need not panic. In fact these are great times to double down and invest in high quality stocks in the markets. This is also an opportune time to revisit your asset allocation, if you have a lot of your net-worth tied up in debt funds or real estate, redeploying it into equities can help generate significant wealth over the next 3 to 5 years. Those with ability to tolerate risk (high net-worth, low commitments) must reconsider their risk-appetite (if not high) and evaluate investing in quality stocks now.

As the markets digest the ‘surprise’ and look forward the next events like budget, or the next state election, the onward march shall continue. Take a wise decision now and reap the rewards later.