Financial Planning and Tips on Sending Money To A Child Overseas

Overseas Money Transfer Simplified. Making every rupee count abroad.

Navigating the waters of international money transfers can be challenging for parents. From understanding currency exchange strategies to ensuring their child studying abroad receives every rupee, expert guidance becomes invaluable.

Why Overseas Money Transfer Matters?

Saving Rupees

By strategising currency exchanges, you can maximise the rupees sent overseas.

Reliability

Ensuring funds reach securely and on time is pivotal for a student’s uninterrupted education.

Understanding Norms

Different countries have varying regulations around receiving international funds.

Avoiding Delays

Financial Assurance

Knowing their finances are secure gives students the mental space to focus on studies.

Expertise Matters

Navigating this process without guidance can lead to unexpected costs and setbacks.

Overseas Money Transfer Services

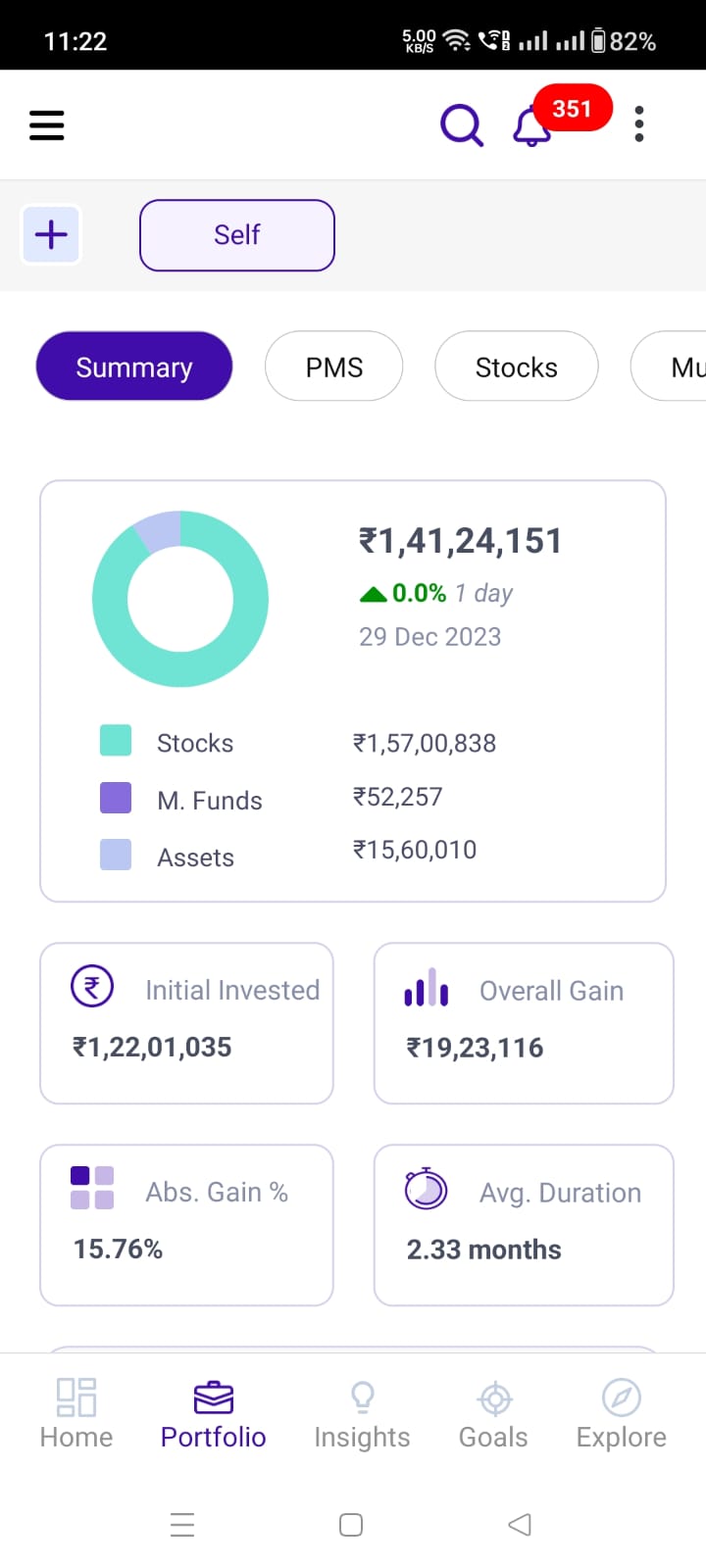

Portfolio Management

Building a diversified investment portfolio to maximise returns for overseas education funds. By leveraging our deep market insights, we align investments with your financial objectives.

Investment Advisory

Personalised advice on international investment options. Tailor-made investment strategies designed around the unique financial needs of funding overseas education.

Comprehensive Financial Planning

Aligning financial goals with overseas education expenses. We ensure every financial decision contributes to your child's educational dreams abroad.

Insurance Solutions

Providing coverage for unexpected events during overseas education. Protect your investments and ensure uninterrupted education for your child.

How Our Unique Approach Elevates Your Transfers

Deep Expertise

Our expertise in mutual funds ensures optimal financial planning.

Mobile Integration

Use our integrated mobile and web app for a seamless transfer experience.

ISO Certified

Trust in our ISO 9001 certified processes for secure and efficient transfers.

SEBI Registered

As a fiduciary, our SEBI registration assures transparent and genuine advice.

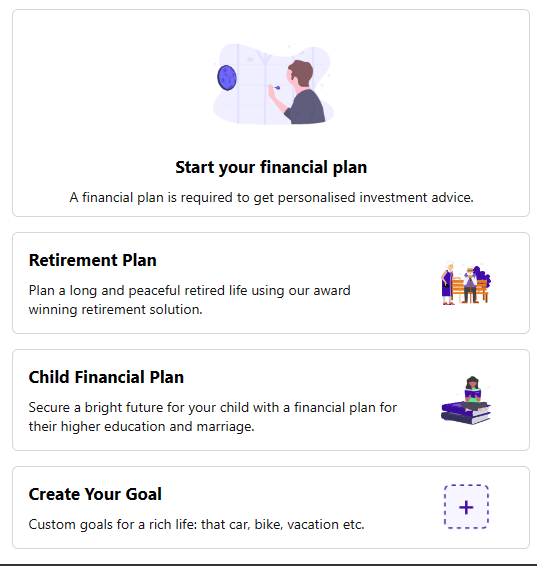

Financial Goal Mapping

Our assurance approach maps your investments to long-term goals, like your child's education.

No Third-Party Bias

Our proprietary analytics focus on objective advice, untainted by external biases.

Benefits of Overseas Money Transfer

Optimal Currency Conversion

Benefit from the most favourable exchange rates and save on every transfer. Our experts monitor global markets to pinpoint the best times for currency conversion.

Financial Security

Assurance that your child's education funds are secured and growing. Our portfolio management ensures investments are risk-averse and yield-driven.

Customised Strategies

Tailored advice that caters to individual financial scenarios. We provide strategies that best suit your financial goals and your child's education needs.

Hassle-Free Experience

With our expert guidance, sending money abroad becomes a seamless process. We handle the complexities, so you can focus on your child's future.

Frequently Asked Questions

How secure is the transfer?

Every transaction is encrypted and monitored. Our SEBI registration and ISO certification further bolster security, ensuring peace of mind.

Are there hidden charges?

No, our process is transparent. We guide you through all potential costs, ensuring no unpleasant surprises.

How do currency exchange strategies work?

Through monitoring and insights, we help you transfer when rates are most favourable, maximising the value of your money.

Can I set regular transfers?

Absolutely, regular remittance plans ensure your child has funds when needed.

How do you offer support to students directly?

We provide financial advisory for students overseas, ensuring they manage received funds optimally.

What sets your service apart?

Our unique, unbiased approach, integrated tech solutions, and deep market expertise ensure unparalleled service quality.